Mortgages

Whether you're buying your first home, upgrading, or building your dream house from the ground up, our mortgage solutions are designed to support you every step of the way. Enjoy flexible terms, competitive interest rates, and personalized guidance to help you turn your goals into reality.

Before you start house hunting, sign a purchase agreement, or consider switching your existing mortgage to the Credit Union, we encourage you to check what you may qualify for below

This tool helps you estimate a comfortable mortgage amount, understand how much you may be able to borrow, and identify a realistic price range for your home—so you can move forward with confidence.

Check What You May Qualify For

Once you’ve identified a property or a mortgage amount that fits your budget and goals, select Apply Now to start your application. Our team will guide you through the process from start to finish.

Apply Now

Before you start house hunting, sign a purchase agreement, or consider switching your existing mortgage to the Credit Union, we encourage you to check what you may qualify for below

This tool helps you estimate a comfortable mortgage amount, understand how much you may be able to borrow, and identify a realistic price range for your home—so you can move forward with confidence.

Check What You May Qualify For

Once you’ve identified a property or a mortgage amount that fits your budget and goals, select Apply Now to start your application. Our team will guide you through the process from start to finish.

Apply Now

Mortgage Calculator

Loan Type *

Amount Required * $ KYD$ KYD

$ KYD$ KYD

Payment Amount

$0.00

APR%

DISCLAIMER: The calculations are based on the information provided and are intended for illustrative purposes only. They should not be considered as specific financial advice. Actual outcomes, including loan or line of credit payment amounts and repayment schedules, may differ. The calculator assumes a constant interest rate throughout.

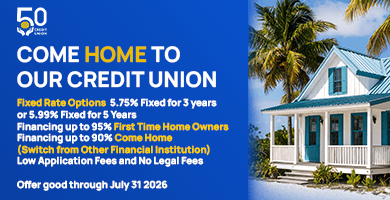

Affordable Mortgages with Built-In Member Benefits

Our Credit Union makes homeownership easier with flexible mortgage solutions tailored to fit your needs. Whether you're purchasing a new property or building your dream home, our competitive rates and no hidden fees help you save more from day one.

Interest Rebate (Cash Back): Receive up to 3% of the loan interest paid back annually for loans in good standing

Financing up to 80% of the property’s market value

Credit Union Assets For Sale

FAQs

Let your Credit Union support you on the journey to owning your home.

Mortgage

Yes, refinancing is available.

Completed mortgage application,

Two photo IDs,

Employment letter & recent pay slip,

Financial statements or Statement of Affairs,

Additional documents if needed

Typically, 10%–20%, depending on the property and borrower profile.

Use the online mortgage calculator, then email [email protected] to book an appointment for formal pre-approval.