| Sunday | Closed |

| Monday | 09:00 AM - 04:00 PM |

| Tuesday | 09:00 AM - 04:00 PM |

| Wednesday | 09:00 AM - 04:00 PM |

| Thursday | 09:00 AM - 04:00 PM |

| Friday | 09:00 AM - 04:30 PM |

| Saturday | Closed |

Frequently Asked Questions (FAQs)

Here are the topics for our most frequently asked questions with answers:

- Non-member Depositors

- Dividends

- Permanent Shares

- The Credit Union New Development

- Strategic Plan 2023-2025

- Credit Union Rules (2022 Revision)

- Service Delivery Channels

- Compliance

- Risk Appetite Statement

- Feedback (Complaints, Suggestions and Compliments) to the Credit Union

- Interest Rates

- Online Transfers

- Interest Rebate

- General

- How to Avoid Paying Fees

NON-MEMBER DEPOSITORS

Q. Will non-member depositors have the same benefits as members?

A. No, non-member depositors do not own shares, only fixed deposits. Therefore, they are not eligible for dividends and interest rebates, as they can't borrow from our Credit Union.

Q. Will non-member depositors receive more favourable rates than members on new fixed deposits?

A. No, members with new funds will receive the same rates as non-member depositors on our fixed term deposits product.

Q. Why doesn’t the Credit Union rely solely on deposit growth from new members?

A. Existing members are aging and saving less, whereas new members mostly demand loans.

When the demand for loans is high, the non-member deposit product will increase liquidity and we will be able meet members' demands.

If lending slows, then earnings and dividends will be reduced.

When the demand for loans is normalized or low or when liquidity is high, our Credit Union will not seek non-member deposits.

Q. Can non-member depositors vote in AGM or Special General Meetings?

A. No, non-member depositors cannot vote as they are not members/shareholders.

Q. Can non-member depositors be nominated for a position on the Board or the Credit or Supervisory Committee?

A. No, only members may be nominated for these positions.

Q. Are tourists and work-permit holders eligible to become non-member depositors?

A. No, non-member depositors must be an employer established under the bond, or a local Caymanian/established Caymanian company or non-profit organisation.

Q. Will a non-member depositor be able to place an unlimited amount of funds on a fixed deposit with the Credit Union?

A. No, limits will be put in place for an individual as well as an institution(company/NPO); limits will require Board of Directors approval.

Q. How will interest rates be determined?

A. The Board will continue to set rates in accordance with our policy.

Q. Will there be procedures in place for accepting non-member depositors?

A. Yes, the Credit Union will ensure that staff are equipped with written procedures to follow when on-boarding these customers. Due diligence will also be carried out in accordance with CIMA’s Rules/Guidance and on-going KYC monitoring.

Q. Will non-member depositors have savings accounts that will allow them to use the Credit Union like a bank and avoid bank fees?

A. No, savings accounts will only be used to deposit funds, which will then be placed on fixed deposit and to withdraw funds once a fixed deposit matures.

Q. How will the Credit Union monitor non-member accounts?

A. The Credit Union will prepare monthly reports for the Board to ensure compliance with procedures established for non-member depositors, which will include total amounts compared to limits, interest rates, deposits matured, new deposits and any other relevant information.

The Risk & Compliance Department, as well as the Internal Auditor, will also review and audit compliance with procedures.

Q. How will the Credit Union use the funds deposited by non-members?

A. The Credit Union will use non-member deposits to build excess liquidity while it continues to use member deposits for lending and investment projects. These funds will enable us to continue to grow as we encourage our members to save.

Dividends

Q: How are Dividends Calculated?

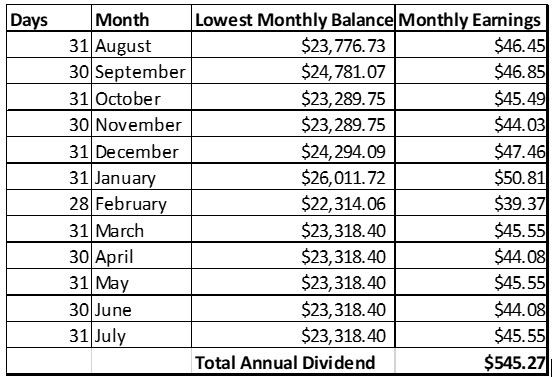

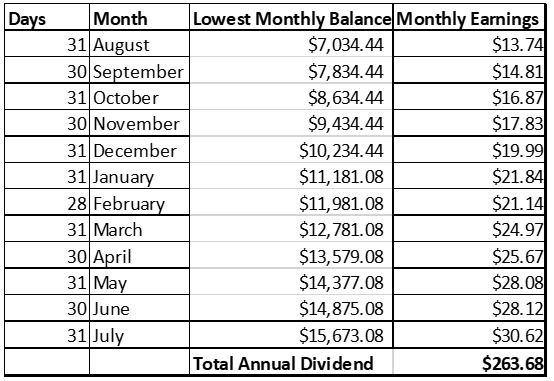

A: Dividends are calculated using the lowest monthly balances over a 12-month period (August to July) and applying the dividend rate, then, adding all 12 months together

The formula to calculate the dividend is:

- (Lowest monthly balance x dividend rate) x (number of days in the month/number of days in the year)= dividend earned for one month; for August below in example 1 (23,776.73*2.3%)*(31/365)= $46.45. Then,

- Add all monthly dividends earned for 12 months = Annual dividend

Please see examples below:

1. Member A is not a consistent saver, as amounts are withdrawn in some months:

2. Member B is also not a consistent saver, and placed a large deposit in his/her shares four months before month -end:

3. Member C has been saving consistently the amount that he/she can afford since joining the Credit Union and each month the monthly earnings are increasing:

SUGGESTION:

- Set up a monthly deduction/standing order to save; save what you can afford without returning to withdraw unless it is a dire emergency.

- Get CUonline and watch your savings grow!

Permanent Shares

Q: What is a Permanent Share?

A: It represents a member’s ownership of, or member’s equity in the Credit Union. This amount cannot be withdrawn while the person remains a member.

Q: Why is it necessary for the Credit Union to implement Permanent Shares?

A1: This gives the Credit Union another option for raising capital. It is also in keeping with the International Financial Reporting (Accounting) Standards that require equity to be treated in a certain way.

A2: Since voluntary shares are not considered capital, permanent shares represent members’ equity in the Credit Union.

Q: How is a Permanent Share different from voluntary shares?

A: The money in voluntary shares can be withdrawn, subject to a notice period if necessary. Permanent shares cannot be withdrawn; they can only be transferred when the member decides to give up membership.

Q: How does a member benefit from having Permanent Shares?

A: It represents your part ownership or equity in the Credit Union and is used for the growth and development of your Credit Union.

Q: Am I not considered an owner of the Credit Union if I only have voluntary shares? Credit Union is a Co-operative so each member is an owner.

A: The Credit Union Rules require members to both permanent and voluntary shares to qualify as a member.

Q: How does the Credit Union benefit from permanent shares?

A: Permanent shares increase the capital of the Credit Union and allows it to undertake expansion and enhancement of services to the members.

Q: Will Permanent Shares ever replace current Voluntary Shares?

A: No. The Credit Union Rules require two types of shares, both Permanent and Voluntary.

Q: Will I get dividends on my Permanent Shares?

A: Dividends may be paid on permanent shares if recommended by the Board of Directors and approved by members in an annual meeting.

Q: If dividends will be given to Permanent Shares, will it be more than what I can earn from the voluntary shares?

A: Yes, more details will be provided to all members when this is proposed.

Q: Who and what will determine how much Permanent Shares members will need to have?

A: These decisions will be made by members in general meetings on the recommendation of the Board.

Q: Is there a maximum amount that I can invest in Permanent Shares?

A: The current maximum requirement at this time is $100.

Q: Will Permanent Shares give more control to one member over another member?

A: No. All members will have the same number of Permanent Shares and in keeping with the principles of cooperatives, each member has one vote.

Q: Can I use my Permanent Shares as collateral?

A: Permanent shares are not intended to be used as collateral. Members have the option of using their voluntary shares to provide collateral for their loans.

Q: Can Permanent Shares ever be withdrawn?

A: No. In case of death or resignation as a member, the Credit Union may buy back the shares using a special fund called the share transfer fund.

Q: I currently own $25 in permanent shares. Do I have to increase my investment to $100?

A: Yes, the Credit Union Rules (2023 Revision) increased the requirement for permanent shares from $25 to $100.

DEVELOPMENT

For more information about our development, please click here.

Q: Where is the Development located?

A: The Development is located between Smith Road and Elroy Arch Rd.

Q: What is the name of the Development?

A: The name of the residential development is Verdant Terrace; It was named in a member competition.

Q: How many residential units will be built for sale?

A: The residential complex will include 62 apartment units

Q: What is the square footage of each residential unit?

A: Each unit will consist of 1,100 square feet.

Q: How many bathrooms and bedrooms will be in each unit?

A: Each unit will have 2 bedrooms and 21/2 bathrooms.

Q: Are there any one-bedroom units?

A: No, just 2-bedroom units.

Q: What else will be constructed on the development site?

A: a 3-story commercial purpose-built facility with a proposal for two floors to be leased and one floor to be purchased.

Q: When will the construction of the residential units begin?

A: In the first quarter of 2023.

Q: How will the Credit Union Fund the costs of construction?

A: The development will be funded from excess cash not loaned to members.

Q: Will the units be sold pre-construction, and when will pre-sales begin?

A: Based on ever-changing construction costs, a date to start pre-sales has not yet been set; however, we keep all our members informed as decisions are taken.

Q: Who will qualify to purchase these units, members, non-members, or both?

A: We have had much interest being expressed by members, and as such, we hope that all units will be purchased by members; the priority will be to sell to qualified borrowers who are members.

Q: If more members qualify than units for sale, what criteria will determine who the unit will be sold to?

A: We will employ a fair system that will give preference to qualified members who are first-time homeowners, then to qualified members based on a credit risk score.

Q: When will the Development Project start?

A: We continue to manage the demand for loans during this high-interest rate period and plan to commence the project in 2024.

STRATEGIC PLAN 2023-25

Q: Why and how did this Plan come about?

A: After a 5-year period of rapid growth and development, our Credit Union wanted to take a comprehensive assessment of our current environment and look beyond to determine the direction for the next three years. We also wanted to give our members the opportunity to participate in the direction we should take in the next 3 years as we enhance our service and continue to provide a return to our members.

Q: Who was involved in coming up with the Plan?

A: Our Board of Directors, Consultants, Management and staff, Member Steering Committee (11 members) , and the 1,692 members who responded to the surveys.

Q: What are the strategic goals identified for 2023-2025?

A: The strategic goals are:

- Loan Portfolio Growth – maximizing service delivery;

- Enabling Legal and Regulatory Framework – modernize and strengthen governance framework;

- Member Engagement and Inclusion – growth of membership;

- Financial Safety and Soundness – monitor key performance indicators;

- Capacity Development – expansion to Country Corner in Savannah and Implement Document Management System;

- Partnerships – a collective undertaking to build healthy and exemplary relationships with employers under the bond; and

- Climate Change Resilience – provide awareness and education training, and green loans

Q: How will members be updated on the progress of this Plan?

A: Members will be updated at each AGM on our progress in implementing the Plan.

Q: When will the full plan be available to members?

A: The Plan will be made available to members on requests; however, we also intend to provide a streamlined version of the plan on our website by 31 January 2023.

CREDIT UNION RULES (2022 REVISION)

To read our existing Credit Union Rules and the 2022 Revision, please click here.

Q: When were the Rules last updated?

A: The Credit Union Rules were:

Last, comprehensively reviewed in 2012; however, some amendments were approved by members at the AGM in 2018, 2019, and 2020.

Q: Why did we update the Rules in 2022?

A: To strengthen the governance framework:

- In an environment of increasing legislation and regulation which directly impact the operations of Credit Union.

- Such that the role of the Board and Committees are clearly defined and in line with best practices.

- To manage the operations of the Credit Union effectively and efficiently:

- Such that the Credit Union governance framework allows for sustainable growth in its membership and deposit base to enable it to meet the financial needs of its members.

Q: Who was involved in updating the Rules?

A: The Board of Directors, Committee Members, multiple focus groups from members, staff, and a consultant.

Q: When will the revised Rules come into effect?

A: No, they will be formatted, policies to support the amendments will be completed, and then the Rules will be forwarded to the Registrar for the final approval.

Q: When will they come into effect?

A: The revised Rules were approved by the Register on 7 July 2023 and as such were in effect as of that date.

Q: When the Rules come into effect, will existing members be given time to increase their permanent share investment from $25 to $100?

A: Yes, members will be given up to six months.

SERVICE DELIVERY CHANNELS

Q: Where do I go to get access to service from my Credit Union?

A: The Credit Union provides service through various delivery channels:

- Branches- We currently have two branches operating in Grand Cayman and Cayman Brac; a third Branch will be opened in 2023 in Savannah. Stay tuned for more information on this Branch.

- Online- Our CUonline service is available to all members any and everywhere in WIFI.

- ATMs- We currently operate three ATMs, and in 2023 we will be completing a business case for another ATM in West Bay.

- CUconvenience- Our newest service channel provides an opportunity for you to request services via telephone or email. Our Member Service Representative will call you back to confirm your identity and then process your request. This channel provides all services that do not involve cash.

Compliance

Q: Why do I have to get my identification documents certified?

Where the Credit Union has not had sight of any original documents being provided for its know your client (KYC) procedures, copies of such documents can only be accepted where it has been certified in accordance with the CIMA Guidance Notes. The Guidance Notes require that a certifier must be a suitable person (eg a lawyer, accountant, director or manager of a regulated entity, a notary public, a member of the judiciary or a senior civil servant). This certifier should sign the certified document and clearly state his/her name and the capacity they are signing in and include their contact address and phone number.

Q: Why must I complete a Source of Funds form for a cheque from a local bank?

A: The Credit Union is legally required to know its customers, including identifying and verifying the source of funds of its members. This includes when cheques/drafts drawn on another financial institution are being deposited by a member. Although the relevant financial institution has the equivalent obligation to know its customers, the Credit Union is not able to rely on the due diligence measures of that institution and is legally required to conduct its own due diligence checks.

Q: Do I have to have both IDs current?

At the time of account opening, you are required to provide 2 forms of photo ID. However, you are only required to have 1 valid form of photo ID thereafter.

Q: Why do I have to have any ID?

A: The Credit Union is legally required to know its customers and verify their identity in accordance with the Anti-Money Laundering Regulations and CIMA Guidance Notes. Collecting your identification documents is a part of this process.

Q: Why do I have to get my identification documents certified?

A: Where the Credit Union has not had sight of any original documents being provided for its know your client (KYC) procedures, copies of such documents can only be accepted where it has been certified in accordance with the CIMA Guidance Notes. The Guidance Notes require that a certifier must be a suitable person (eg a lawyer, accountant, director or manager of a regulated entity, a notary public, a member of the judiciary or a senior civil servant). This certifier should sign the certified document and clearly state his/her name and the capacity they are signing in and include their contact address and phone number.

Q: Why must I complete a Source of Funds form for a cheque from a local bank?

A: The Credit Union is legally required to know its customers, including identifying and verifying the source of funds of its members. This includes when cheques/drafts drawn on another financial institution are being deposited by a member. Although the relevant financial institution has the equivalent obligation to know its customers, the Credit Union is not able to rely on the due diligence measures of that institution and is legally required to conduct its own due diligence checks.

Q: Do I have to have both IDs current?

At the time of account opening, you are required to provide 2 forms of photo ID. However, you are only required to have 1 valid form of photo ID thereafter.

Q: Why do I have to have any ID?

A: The Credit Union is legally required to know its customers and verify their identity in accordance with the Anti-Money Laundering Regulations and CIMA Guidance Notes. Collecting your identification documents is a part of this process.

RISK APPETITE STATEMENT

Q: What are the main risks the Credit Union face and what is our tolerance for these risks?

A: The Credit Union is exposed to and has a low to moderate tolerance for:

- Financial risks such as credit, interest rates, and investment values.

- Strategic risks in achieving its strategic objectives.

- Operational risks such as human resources, compliance, fraud, information technology, outsourcing, and legal.

- Reputational risks.

- Governance risks.

Q: How do we monitor, prevent, and remediate these risks?

A: We have developed a risk management framework that outlines the role of the Board, the CEO, the Chief Risk Officer, the Executive Risk Management Committee, the Internal Auditor, managers, and all other staff members.

Q: Why do we care about risks?

A: It is necessary to identify what could go wrong and analyze its impact on the operations of the Credit Union so that we may put controls in place to prevent or mitigate the risks. We want to ensure that our members, employees, and assets are protected.

FEEDBACK ( Complaints, suggestions, and compliments) TO THE CREDIT UNION

We want to enhance your member experience. Whether you have a suggestion, compliment, or complaint, we welcome your feedback!

For more imformation on giving feedback to the Credit Union, please click here.

Q: How do I provide feedback to my Credit Union?

A: Feedback may be provided as follows:

- Log into the website www.creditunion.ky and click on the “member feedback” link (located just above CUonline).

- Send an email to feedback@cicsacu.com.ky

Q: What should I expect when I submit feedback?

A: Members should expect the following:

- An instant reply email from feedback acknowledging receipt of your email.

- In 24 hours, you should receive a response from the responsible manager or designate of the relevant department, which will provide an acknowledgement and/or explanation within 3 business days pending an investigation.

- A response that provides clarity to your issue and provides an explanation or resolution.

INTEREST RATES

Q: Are interest rates at the Credit Union based on the Cayman Islands Prime Interest Rate used by commercial banks?

A: NO, Our Credit Union assesses economic conditions, such as unemployment and cost of living, that impact our members. We strive to keep interest rates steady so members can budget loan payments, which are usually the largest part of their expenses.

We try to remain consistent over time rather than reacting every time rates change in the market. In extreme economic conditions, we will reduce our interest rates in such a way to manage the expectations of member borrowers and members who only save with us.

Q: How often does the Credit Union change interest rates?

A: See the history of changes below since 2007, when mortgages were introduced:

- 2007: 10.75%

- 2009: 9.75%

- 2010: 6.75%

- 2020: 6.75 dropped 1% to 5.75% in response to the Pandemic

- 2022: 5.75% increased by 0.75% to 6.5% after full opening of our borders

- 2023: 6.75%

The rate changes above clearly demonstrate that the Credit Union reacts to extreme market conditions; the period 2007-2010 was the great “Financial Crisis” for the world, and the Credit Union decreased interest rates by 3% during that period. Again, in 2020 at the beginning of the Pandemic, our Credit Union reduced rates by 1%.

Q : Does the Credit Union interest rates change with the Cayman Islands Prime Interest Rate changes?

A: No, Rule 20J states “Rates of interest shall be applied on the approval of the authorised officer but within the range fixed from time to time by the Directors.” Rule 21 V2…Directors undertake the following ongoing specific duties. “To determine the interest rate on loans from time to time.”

ONLINE TRANSFERS

The Credit Union is not yet a part of the Automated Clearing House (ACH) which would enable transactions directly between the Credit Union and commercial banks. However, members who have accounts with commercial banks can still transfer funds to the Credit Union’s accounts at Butterfield and CNB. For specific instructions on how to transfer, please click here.

Q: When I transfer my funds from the bank to the Credit Union’s account, when will I see the funds in my Credit Union account on CUonline?

A: Funds are downloaded daily and posted to members’ Credit Union Accounts, usually within 24 hours.

Delays may occur if:

- Member does not provide their account number details when doing an online transfer; and

- Member deposit exceeds their declared limit or $5,000, whichever is highest.

Q: Which account will the Credit Union deposit my funds to?

A: The Credit Union will transfer your funds to your savings account, and you may then use CUonline to transfer funds to your share account or to another member’s account or to pay your loan.

Q: Why do I have to complete a source of funds form before my transfer is deposited to my Credit Union Account?

A: If your deposit is higher than the amount you declared as being your monthly deposit or it exceeds $5,000, you must complete a source of funds form, and you may also have to provide additional documents based on the source of funds; this in accordance with the Anti-Money Laundering Regulations.

You should receive an email from the Credit Union requesting the source of funds form. As soon as the information is received, your funds will be transferred to your account.

INTEREST REBATE

Q: What is an interest rebate?

A: An interest rebate is cash back in your account based on the following:

Make all loan payments on time/on the due date; one late payment for the year disqualifies you from getting the rebate.

Q: How is the interest rebate calculated?

A: The Directors approve a percentage for interest rebate at the beginning of the financial year, up to 3% of interest paid by members for the financial year. If the rate approved is 2%, this rate is applied to total interest paid for the financial year.

Q: When do I get the cash back?

A: Interest Rebates are usually paid to your share account in December

GENERAL

Q: How does the Credit Union earn its income to pay dividends?

A: The main income stream for the Credit Union is from interest income earned on loans to members; 90% of net surplus is derived from interest earned on loans to members.

Q: Will the Credit Union be offering a loan payment waiver (skip-a-payment) in December?

A: NO:

- Waivers for "unplanned expenses" are a risk as they may extend the repayment term of the loan past the retirement age of 65 years and result in members paying more interest.

- Even if you get a waiver, Interest is still charged but added to the outstanding loan balance- thereby extending the maturity date.

- Waivers should only be used for medical emergencies.

Q: Why is property insurance for a home purchased or constructed under a mortgage from the Credit Union required to be updated before you can conduct a transaction?

A: Property insurance covers all perils such as damage from fire, earthquakes, hurricanes, etc. The Credit Union has a charge placed on your property in case of default of loan payments. In order to protect its interest in the property, insurance is required. More so, the primary reason is to protect your property/home incase of catastrophes which will require you to claim on the insurance for repairs/rebuild.

HOW TO AVOID PAYING FEES

Non-Compliant fee- To avoid a non-compliant fee, submit any requested due diligence to the Credit Union promptly and within the stipulated deadline. This may include, but is not limited to, providing updated identification, proof of address documentation, and updated proof of the source of funds to your account, ensuring compliance with Anti Money Laundering Regulations.

Loan late payment fee- charged when you loan payment is made after the due date; make sure you know the date that your loan payment is due and pay your loan before on that date. TIP: pay loan online with CUonline.

Dormant Account fee- is applied to your account on an annual basis if your account is not used for 12 consecutive months; avoid this fee by saving monthly, whatever amount you can afford.

Cash Withdrawal fee- is applied whenever you come to the Branch and withdraw cash; avoid this fee by applying for or using your ATM card, FOR FREE, at one of our 3 ATMs.